Ebay shares are down nearly 4 percent in after-hours trading, after the online auction company’s earnings fell below Wall Street forecasts. However one of the keys to Ebay’s future as a viable company could be its link to the mobile payment service Paypal.

Worldwide mobile payments are expected to surpass $1 trillion by 2017. The huge market is fueling competition from the tech industry. Online auction house eBay recently ended its links with PayPal. They are now two separately traded companies. Many analysts believe it will allow each to move more quickly to take on competitors like Amazon and in the mobile payment arena.

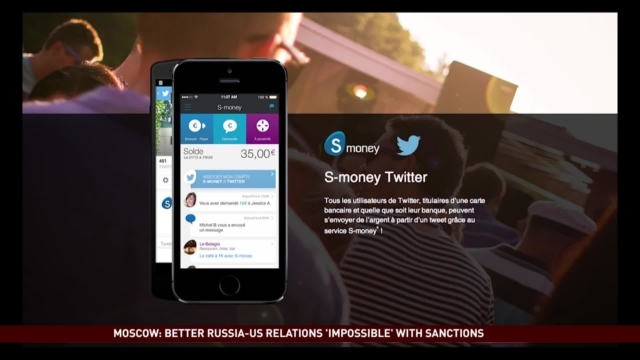

Social media companies like Facebook and Twitter also began offering a peer-to-peer mobile payment service in France called S-Money. PayPal, however, acquired the social payment network, Venmo, in 2013.

The competition only gets tougher as Apple’s new network, Apply Pay, is expected to launch this week. Users securely store credit card data on their iPhones, and then pay by tapping the phone in stores. This feature which has existed on Android phones for some time.

While it’s too early to predict a winner in the mobile payment industry, analysts agree that those that succeed will have to demonstrate both convenience and a fraud-free track record.

CCTV America’s Mark Niu reports.

Ed Busby, the founder of the mobile consulting firm Hudson Mobile Advisory, spoke with Biz Asia America about the mobile payment industry and global expansion prospects.

CGTN America

CGTN America